utah county food sales tax

Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. Municipal governments in Missouri are also allowed to collect a local-option sales tax that ranges from 05 to 7763 across the state with an average local tax of 3679 for a total of 7904 when combined with the state sales tax.

How To Register For A Sales Tax Permit In Ohio Taxjar

The maximum local tax rate allowed by Missouri law is.

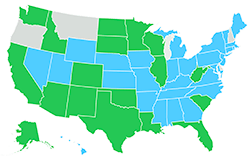

. The tax would be eliminated Jan. State regional and county information. Utah is one of just 13 states that still includes groceries at least partially in their sales tax bases noted Jared Walczak vice president of state projects with.

The Pierce County Sales Tax is collected by the merchant on all qualifying sales made within Pierce County. Municipal governments in Wisconsin are also allowed to collect a local-option sales tax that ranges from 0 to 175 across the state with an average local tax of 0481 for a total of 5481 when combined with the state sales tax. The Nassau County Sales Tax is collected by the merchant on all qualifying sales made.

Grocery food is food sold for ingestion or chewing by humans and consumed for taste or nutrition. Wisconsin has a statewide sales tax rate of 5 which has been in place since 1961. The Pierce County Washington sales tax is 930 consisting of 650 Washington state sales tax and 280 Pierce County local sales taxesThe local sales tax consists of a 280 special district sales tax used to fund transportation districts local attractions etc.

Utah Economic Data Viewer is a tool for studying occupations profiling occupational wages quantifying industry employment and wages finding firms downloading unemployment rate information and exploring population estimates. We weight these numbers according to Census 2010 population figures to give a sense of. Sales for special events should be included in the gross sales reported on Line 1 of the regular sales tax return.

For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here. Sales Tax Clearinghouse publishes quarterly sales tax data at the state county and city levels by ZIP code. The tax on grocery food is 3 percent.

The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc. State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town. If the vendor has a permanent sales tax license the vendor must report and remit the sales tax from the event on Form TC-790C in addition to reporting it on the vendors regular sales tax returns.

Missouri has a statewide sales tax rate of 4225 which has been in place since 1934. If you do not have a Utah sales tax licenseaccount report the use tax on line 31 of TC-40. Under House Bill 2106 the state would lower the states sales tax on groceries to 4 on Jan.

Special event sales should. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. If a locality within a county is not listed with a separate rate use the county rate.

Jobs main content. It would slide to 2 by Jan. The maximum local tax rate allowed by Wisconsin law is.

Cottage Food Sales Tax Understanding The Basics Castiron

Utah Maple Syrup Orchards And Sugarworks Find A Local Maple Syrup Farm Near You In Utah To Buy Local Maple Syrup Even See It Being Made

Utah Sales Tax Information Sales Tax Rates And Deadlines

Utah Sales Tax Small Business Guide Truic

Genola Utah Ut 84655 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

As Food Prices Soar Some States Consider Cutting Taxes On Groceries

Lindon Utah Ut 84042 84604 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Lindon Utah Ut 84042 84604 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders